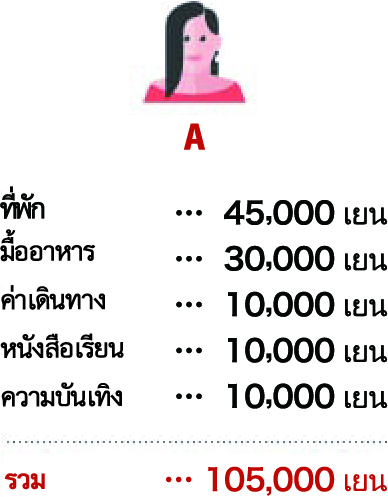

ตัวอย่างการเปรียบเทียบค่าใช้จ่ายของนักเรียนที่อาศัยภายในเกียวโต

● ตัวอย่างการเปรียบเทียบค่าใช้จ่ายของนักเรียนที่อาศัยภายในเกียวโต

● ค่าใช้จ่ายโดยเฉลี่ยของนักเรียนต่างชาติ (ในภูมิภาคคิงกิ)

- □ รายได้เฉลี่ยต่อเดือน:งานพาร์ทไทม์ 56,000 เยน

- □ ค่าใช้จ่ายรายเดือนโดยเฉลี่ย:ที่พัก 37,000 เยน อาหาร 26,000 เยน

อ้างอิง : สรุปผลการสำรวจสภาพความเป็นอยู่ของนักเรียนต่างชาติส่วนบุคคลประจำปี 2021

ราคาขายปลีกโดยเฉลี่ย

อ้างอิง : การสำรวจราคาขายปลีกประจำปี 2022 (แบบสำรวจแนวโน้ม) โดยสำนักงานสถิติ กระทรวงกิจการภายในและการสื่อสาร

ภาษี

การชำระภาษีถือเป็นภาระหน้าที่ในญี่ปุ่น ภาษีหลักที่เกี่ยวข้องกับนักเรียนต่างชาติมีดังต่อไปนี้

ภาษีเพื่อการบริโภค

อัตราภาษี 10% จะถูกเรียกเก็บจากจำนวนเงินที่ชำระเมื่อซื้อสินค้าหรือรับบริการ อย่างไรก็ตาม อาหาร หนังสือพิมพ์ และรายการเฉพาะอื่น ๆ จะใช้อัตราภาษีลดลงเหลือ 8% ราคาอาจระบุว่ารวมภาษีแล้วซึ่งในกรณีนี้ภาษีเพื่อการบริโภคได้รวมอยู่ในราคาแล้ว หรืออาจระบุว่าไม่รวมภาษีซึ่งในกรณีนี้จะยังไม่รวมภาษีเพื่อการบริโภคแต่เรียกเก็บแยกต่างหาก

ภาษีเงินได้ (สำหรับผู้ที่ทำงานพาร์ทไทม์)

ภาษีที่ประเทศเรียกเก็บจากรายได้ส่วนบุคคล ภาษีเงินได้จะถูกหักจากเงินเดือนในทุกเดือน อัตราภาษีคงที่จะใช้กับยอดเงินที่เหลือหลังจากหักค่าลดหย่อนประเภทต่าง ๆ ออกจากรายได้ทั้งหมดภายใน 1 ปี เพื่อกำหนดจำนวนภาษี

● การปรับยอดสิ้นปี

จำนวนภาษีที่หักจากรายได้ต่อเดือนในแต่ละเดือน และภาษีสำหรับรายได้รวมใน 1 ปีอาจไม่จำเป็นต้องเท่ากัน ดังนั้น จึงมีการดำเนินการ “ปรับยอดสิ้นปี” เพื่อชำระส่วนที่เกินหรือส่วนที่ขาด ขั้นตอนดังกล่าวจะดำเนินการโดยบริษัทของท่าน ดังนั้นกรุณาตรวจสอบกับหัวหน้าของท่านในสถานที่ที่ทำงานพาร์ทไทม์